The slowdown in spending by China’s rich is threatening to end a rally in luxury companies that sent shares to all-time highs.

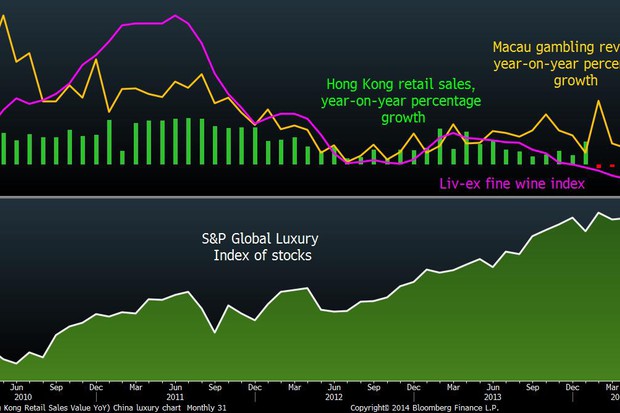

The CHART OF THE DAY shows three gauges affected by weaker Chinese spending: Hong Kongretail sales, Macau gambling revenue and the Liv-ex 100 Fine Wine Index. While those measures are turning lower, the S&P Global Luxury Index of 78 companies is trading within 2 percent of a record after more than doubling over the past four years.

Chinese appetite for pricey watches, casino chips and Bordeaux is waning as slowing economic growth, a slumping property market and an austerity campaign on the mainland cut easy access to credit. Spending by wealthy Chinese dropped 15 percent in 2013, a survey by Shanghai-based publishing group Hurun Report showed. Chinese consumers account for 29 percent of global luxury purchases, according to consultant Bain & Co.

Things are going to get “tough” for luxury companies, said Arthur Kwong, the Hong Kong-based head of Asia Pacific equities at BNP Paribas Investment Partners, which manages about $650 billion. “Their major customers are Chinese consumers, for which spending is indeed slowing down significantly.”

Both Cie. Financiere Richemont SA, the maker of Cartier jewelry and Montblanc pens, and Remy Cointreau SA, the manufacturer of Remy Martin cognac, cited lower China demand when reporting full-year earnings. Growth in the world’s second-largest economy slowed to 7.4 percent last quarter from a year earlier, compared with 11.9 percent three years before.

Pedestrians walk past an illuminated facade of a Coach Inc. store in the Central... Read More

Hong Kong’s retail sales tumbled 9.8 percent in April, the biggest year-on-year drop since 2009. Sales rose an average 16 percent a month in the four years through 2013, spurred by mainland purchases. Macau gambling revenue grew 9.3 percent in May, down from the four-year monthly average of about 34 percent. The Liv-ex 100, which reflects price movements of 100 of the most-sought-after wines, has plunged 32 percent from its 2011 high as China cracked down on official gift giving.

To contact the reporters on this story: Richard Frost in Hong Kong at [email protected]; Weiyi Lim in Singapore at [email protected]

To contact the editors responsible for this story: Michael Patterson at[email protected]

Source: http://www.bloomberg.com